Turkey - Keystone of Global AC Industry

Recently, contrasting phenomena have occurred on the north and south sides of the Black Sea. Ukraine on the north side has been hit by a devastating war, while Turkey on the south side has been experiencing an investment boom. In the Turkish air conditioning market, Daikin and Mitsubishi Electric, the two strong players in the global air conditioning industry, announced at the end of May that they will make further investments in order to expand their local production.

Located at an important crossroads between Europe and Asia, Turkey has the potential to occupy an important position in the global air conditioner market. Daikin and Mitsubishi Electric have selected Turkey as one of their production bases to meet growing demand for heat pumps in Europe against a backdrop of the carbon-neutral policy. Not only air-to-water (ATW) heat pump systems that match European heating culture, but also air-toair (ATA) heat pumps such as heat pump room air conditioners (RACs) and variable refrigerant flow (VRF) systems are benefiting from expanding applications in Europe. In such a context, it is conceivable that other manufacturers will establish their manufacturing capabilities in Turkey in the future.

For manufacturers with production bases in Asia in particular, Turkey is considered to occupy an important position in their global strategies as a production base for air conditioners for Europe. Currently, the turmoil in the global supply chain, including the tightness of marine containers, has become long-standing, and establishing a production base in Turkey seems to be an effective measure. Air conditioners produced in Turkey can be delivered to most European Union (EU) countries without import duty due to the Free Trade Agreement ( FTA) within a shorter period of time by land alone, and the lead time can be significantly shortened compared with shipping from production bases in Asia.

As not only a key to strategies, Turkey is again attracting attention due to its potential as an air conditioner market.

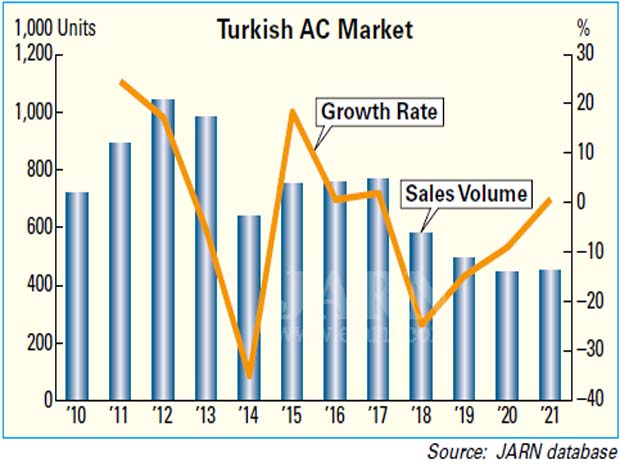

According to ISKID, the Turkish association of manufacturers and/or importers of climatization, refrigeration, and air conditioning devices, behind the growth of the Turkish air conditioner market in 2021, split-type air conditioners were the driving force with sales exceeding one million units and 42% year-on-year growth.

This growth is said to have been boosted greatly by demand for remote work during the pandemic. In addition, the number of split-type air conditioners exported increased significantly, achieving record-high 120% year-on-year growth.

According to the report, sales of VRF systems also increased. While public investments declined, VRFs were not significantly affected.

The mini-VRF market in particular achieved 20% year-on-year growth with increased housing in coastal areas.

Interest in ATW heat pumps has also increased, due to soaring energy prices. ISKID expects that the Turkish ATW market will grow significantly in the future.

Turkey, which has long been considered a high-potential market, has attracted many air conditioner manufacturers, and most brands from Japan, the United States, South Korea, and China have entered the market. Among them, Japanese manufacturers such as Daikin and Mitsubishi Electric have achieved remarkable success. German manufacturers such as Bosch also entered the heating market. Local manufacturers have become stronger, and domestic brands such as Vestel and Arçelik-LG have secured a certain share in the RAC and VRF segments respectively.

Setting up a production base in Turkey will also bring the Middle Eastern and African markets into targeting range, not just Europe.

Several countries such as Saudi Arabia and Egypt impose high tariffs and import restrictions on products from Turkey for religious and political reasons. Nevertheless, establishing a base in Turkey, which is close to these markets, seems to be very important in reducing risks such as transportation costs and stabilization of profits.

In addition, oil-producing countries such as Saudi Arabia and United Arab Emirates (UAE) in the Middle East are expected to grow economically due to high crude oil prices, and are expected to be promising export destinations. When conducting air conditioning business in the Middle East, it may be easier to accept sales activities performed by Turkish staff who are familiar with neighboring countries. Since Turkey has a thriving construction industry, it can be fully expected that sales of commercial air conditioners could go hand in hand with projects conducted by Turkish construction companies operating in neighboring countries.

In the future, Turkey will become increasingly important for the air conditioning industry, not only as a domestic market but also as a production and sales base targeting Europe, the Middle East, and Africa.

Renewables Steadily Increasing in Heating & Cooling in Europe

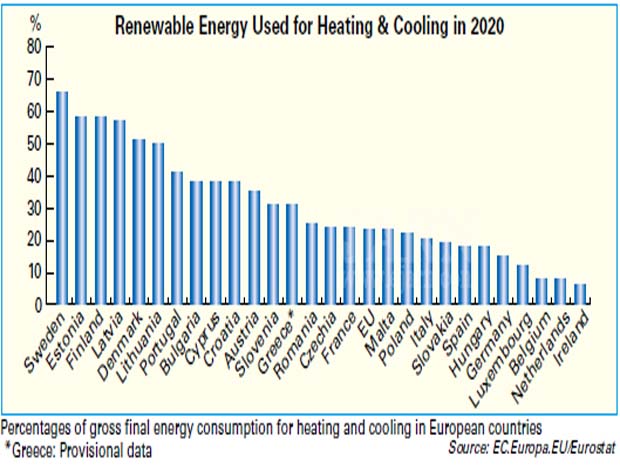

Heating and cooling based on renewable energy sources are steadily increasing according to an article published for the EU Industry Days, a flagship annual event that highlights industrial frontrunners and ongoing industrial policy discussions whilst improving the knowledge base of the European industry.

2020, renewables accounted for 23% of the total energy used for this sector in the EU, which demonstrates a steady increase in comparison to 12% in 2004 and 22% in 2019. Among the key developments cited as accelerating this growth is the electrification process of heating by using heat pumps.

The article shows that Sweden is the strong frontrunner with over 66% of its energy used in heating and cooling coming from renewables. The rest of the Nordic-Baltic region is also leading this trend, with Sweden followed by Estonia with 58%, Finland with 58%, Latvia with 57%, Denmark with 51%, and Lithuania with 50%. Belgium with 8%, Netherlands with 8%, and Ireland with 6% are lagging behind according to the statistics.

Commercial Air Conditioner Market Increases by over 25% in 2021

In 2021, China saw its economic growth rate rising at the beginning of the year but falling in the second half of the year. This phenomenon was also reflected in the commercial air conditioner (CAC) market. The first half of the year saw big growth in China’s CAC market, but the growth rate decelerated in the second half of the year.

According to statistics from Aircon.com, the first half of 2021 saw the CAC market increase by over 35% in China, but that growth rate dropped to only 20% in the second half of the year. Overall, the whole year saw a growth rate of over 25%, hitting a record high in the past decade.

With the 2021 market recovery, the home decoration retail market and engineering project market all presented sound growth. However, 2020 suffered from a market decline triggered by the COVID-19 pandemic, and the annual growth rate of over 25% in 2021 is catchup growth.

The CAC market in China in 2021 has the following features: growth was abnormal in 2021, and was not sustainable; the price increase of CACs was one boost to market growth; the home decoration retail market recovered and increased, but the supporting market of decorated real estate projects faced challenges; the engineering project market revived, enjoying the largest growth rate in recent years; variable refrigerant flow (VRF) systems and centrifugal chillers saw market growth, but the water-cooled screw chiller and unitary chiller markets suffered a decline in their growth rates.

Based on the market features mentioned above, almost all CAC brands have experienced growth in 2021.

Moreover, there was a new change in 2021. Some air-to-water (ATW) heat pump brands were confronted with development bottlenecks, and it was hard for individual companies to expand their scale by selling ATW heat pumps; therefore, they entered the CAC market, offering standard products such as combined systems, unitary products, VRFs, and modular chillers. It is conceivable that competition will intensify among these brands in the future.

For more information, please view: https://www.ejarn.com/index.php

Post time: Jul-04-2022