The United States has mainly used gas-and oil-fired equipment for space heating and hot water supply for many years, but it is now making a decisive shift to electric heat pump heating and hot water supply, to counteract soaring energy prices and achieve carbon neutrality.

The Biden-Harris Administration is making both demand-side investments to spur heat pump manufacturing capacity and workforce development, and supply-side investments to help consumers reap the benefits of a clean energy economy, through the Inflation Reduction Act (IRA), Bipartisan Infrastructure Law, Defense Production Act, and other aligned programs. As one of the most recent investments, on April 18, the U.S. Department of Energy (DOE) announced the authorization of US$ 250 million in funding for its Heat Pump Defense Production Act Program, included in DOE’s Clean Energy Infrastructure Funding Opportunity Announcements.

In addition to these federal government policies, California, Massachusetts, and other states have enacted regulations to encourage a shift from combustion-type heating and hot water supply equipment to heat pump-type heating and water supply equipment. On May 2, the New York Senate and Assembly passed the state budget, which contains a provision banning gas cooking stoves and furnaces as well as propane heating in most new residential buildings.

In this context, on April 4, the first-ever White House roundtable on heat pump manufacturing and deployment was held. Executives from heat pump manufacturers including Carrier, Daikin, and LG, industry associations such as Air-Conditioning, Heating, and Refrigeration Institute (AHRI), distributors, and labor leaders were invited to discuss with administration officials the ways in which government investments will expand the U.S. heat pump manufacturing industry and build a pipeline of skilled workers to meet the growing demand for heat pumps across the country.

ATA Heat Pump Market

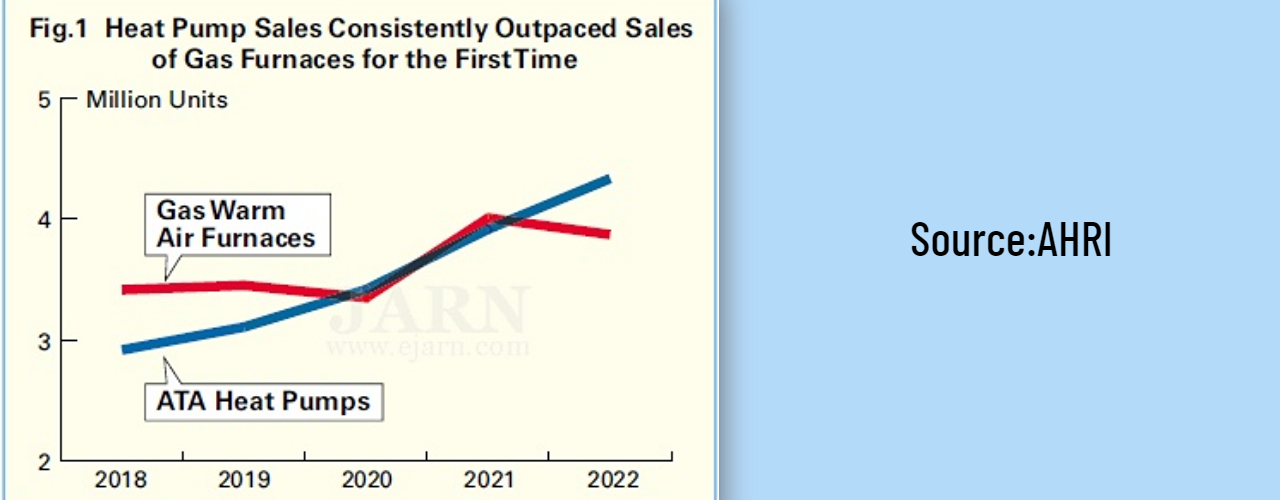

In the United States, air-to-air (ATA) heat pumps are primarily used for space heating rather than air-to-water (ATW) heat pumps. According to AHRI’s U.S. shipment data, ATA heat pump shipments increased from about 2.92 million units in 2018 to about 4.33 million units in 2022, an increase of about 48% in five years. On the other hand, gas warm air furnaces, which are commonly used for space heating in the United States, increased from about 3.42 million units in 2018 to about 3.87 million units in 2022, indicating a five-year growth rate of about 13%, which remained low compared with that of ATA heat pumps. As can be seen from Fig. 1, ATA heat pump shipments began to rival gas warm air furnace shipments from 2020, widening the gap to more than 0.46 million units in 2022.

In cold regions of the United States, ATA heat pumps alone do not have enough heating capacity, so gas and oil furnaces and boilers are often used together. To overcome this issue, many manufacturers are currently working on developing ATA heat pump products with enhanced heating functions for cold regions under the DOE’s Residential Cold Climate Heat Pump (CCHP) Technology Challenge.

ATW Heat Pump Market

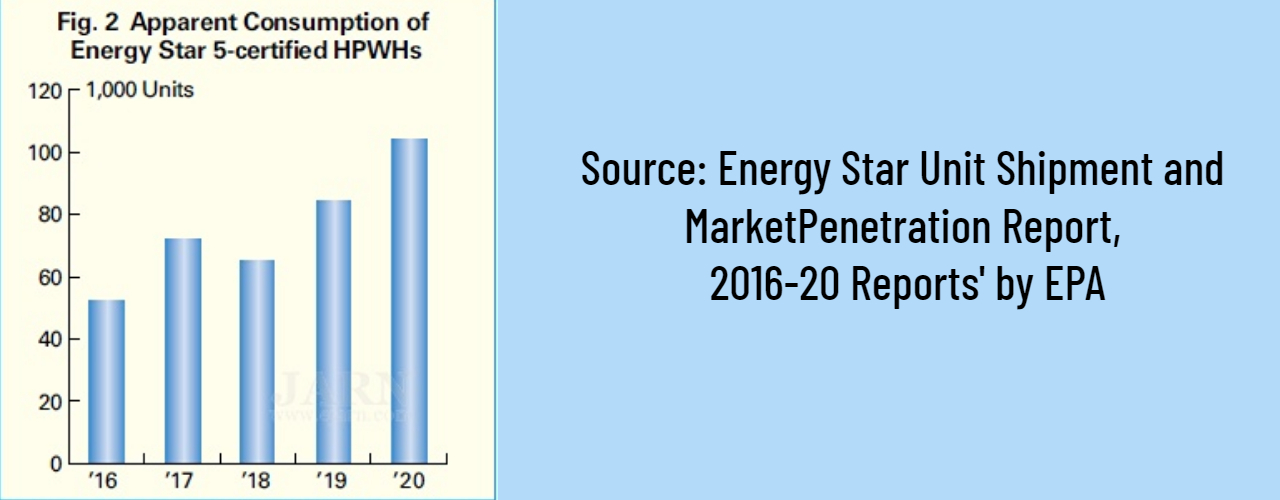

ATW heat pumps are mainly used for water heating, not space heating, in the United States. However, gas-and oil-fired water heaters are still the mainstream, and there is little demand for heat pump water heaters (HPWHs). As of 2020, heat pump water heaters accounted for only 2% of the overall market, according to the Energy Star Unit Shipment and Market Penetration Report, 2016–20 Reports from the U. S. Environmental Protection Agency (EPA).

However, the market size doubled in the five years from 2016 to 2020. Specifically, apparent consumption of Energy Star 5-certified units increased from 52,000 units in 2016 to 104,000 in 2020 as shown in Fig. 2. In addition, almost 7.5 million water heaters are replaced every year according to Advanced Water Heating Initiative (AWHI) research.

U.S. International Trade Commission (USITC) analyzed rapid growth factors of heat pump water heaters: an increase in new home construction, new energy-efficiency codes and requirements, more incentives from manufacturers and various utility companies, and customer preferences for a more efficient product and/or one with a lower operating cost.

A. O. Smith and Rheem supplied more than 70% of the overall U.S. heat pump water heater market in 2020 from their Mexican plants, and offer the most Energy Star-certified heat pump water heater models, according to USITC. In addition to these long-established players, there are new faces in the industry.

At the White House roundtable mentioned above, the government’s policies to promote heat pumps, including subsidies, were welcomed, but issues such as the low awareness of heat pumps among consumers and installers and the shortage of engineers were raised. If the public and private sectors work together to overcome these challenges, the expansion of the U.S. heat pump market will accelerate further.

Post time: May-31-2023